Simple Forex strategies — simple to use, easy to try out.

This collection of Forex trading strategies and techniques is dedicated to help traders in their research and developing of workable trading styles and trading systems.

Attention all users: trading strategies are posted for their educational purpose only. Trading rules may be subject to interpretation. Planned risk levels may be increased dramatically under extreme market conditions. Use the ideas and/or modify them to suit your trading style, but only at your own risk. We recommend testing your trading system on demo account before investing real money.

We start from the very simple Forex trading strategies that will help beginner traders to identify entry and exit points and foresee market turns; and we will gradually move to more serious but still simple Forex trading systems.

As we said, simple trading systems are good for beginners, but won't suit more experienced traders. However, if you have just started learning about Forex, do not skip those strategies as they will preserve consistency in your learning. Advanced strategies were all at some point simple, but later were developed by traders. So, learning the basic ideas behind simple strategies will help you in the long run to advance in your own strategy making.

Before we start: two words about Stop Loss orders – they should be set either in fixed amount of pips (you may try to use 27-30 pips with those simple Forex systems) or, if chart permits, slightly over the last highest price swing point.

Screenshots are made from Oanda trading platform.

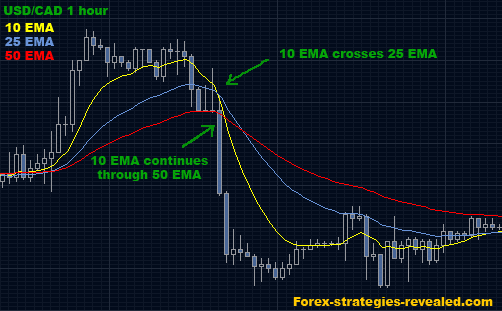

Forex trading strategy #1 (Fast moving averages crossover)

Trading systems based on fast moving averages are quite easy to follow. Let's take a look at this simple system.

Currency pairs: ANY

Time frame chart: 1 hour or 15 minute chart.

Indicators: 10 EMA, 25 EMA, 50 EMA.

Entry rules: When 10 EMA goes through 25 EMA and continues through 50 EMA, BUY/SELL in the direction of 10 EMA once it clearly makes it through 50 EMA. (Just wait for the current price bar to close on the opposite site of 50 EMA. This waiting helps to avoid false signals).

Exit rules: option1: exit when 10 EMA crosses 25 EMA again.

option2: exit when 10 EMA returns and touches 50 EMA (again it is suggested to wait until the current price bar after so called “touch” has been closed on the opposite side of 50 EMA).

Advantages: it is easy to use, and it gives very good results when the market is trending, during big price break-outs and big price moves.

Disadvantages: Fast moving average indicator is a follow-up indicator or it is also called lagging indicator, which means it does not predict the future market directions, but rather reflects current situation on the market. This characteristic makes it vulnerable. First, because it can change its signals any time, second – you need to watch it all the time, third - when market trades sideways (does not trending) with very little fluctuation in price it can give many false signals, so it is not suggested to use it during such period.

http://forex-strategies-revealed.com/

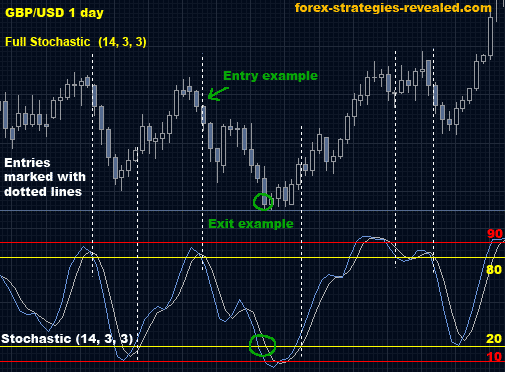

Forex trading strategy #3 (Stochastic High-Low)

Forex systems which adopt a Stochastic indicator for monitoring the price provide some very good tips about the situation on the market for traders that are willing to see it.

Currency pair: Any.

Time frame: Any.

Indicator: Full Stochastic (14, 3, 3)

Entry rules: When Stochastic has crossed below 20, reached 10, and then crossed back up through 20 – set BUY order.

Entry rules: Sell when Stochastic has crossed above 80, reached 90, and then crossed back down through 80.

Exit rules: close trade when Stochastic lines rich the opposite side (80 for Buy order, 20 for Sell order).

Advantages: gives quite accurate entry/exit signals in well trending market.

Disadvantages: needs periodical monitoring. Stochastic is suggested to be used along with other indicators to eliminated entering on false signals.

http://forex-strategies-revealed.com/

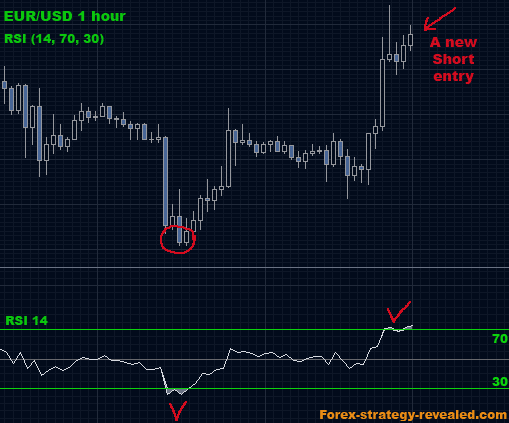

Forex trading strategy #4 (RSI High-Low)

Although no trading system can solely rely on RSI indicator, using it in combination with other tools and proper technical analysis can bring a new edge to your Forex trading.

Setup:

Currency pair: Any.

Time frame: Any.

Indicator: RSI (14, 70, 30)

Entry rules: Buy when RSI has crossed below 30, formed a bottom, and then crossed back up through 30.

Entry rules: Sell when RSI has crossed above 70, formed a peak, and then crossed back down through 70.

Exit rules: not set.

Advantages: RSI is a very good indicator to refer for confirmation for any entry in any simple or complex trading system. For current trading method it advices well on entries, but opportunities occur not that often.

Disadvantages: monitoring is needed, still false signals take place. Strategy is suggested to be used in combination with other ones.

http://forex-strategies-revealed.com/

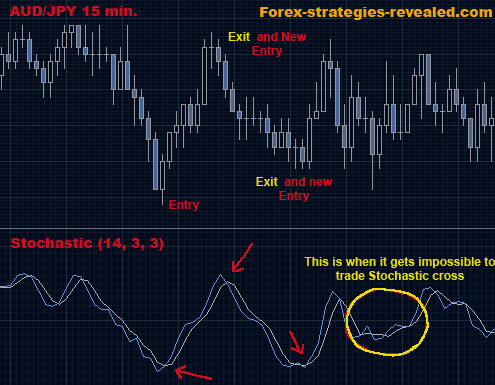

Forex trading strategy #5 (Stochastic lines crossover)

Here is a very basic overview of a role of a Stochastic indicator in the Forex trading. Knowing exactly what to expect from Stochastic, if you ever plan to add it to your own system, will affect trading results dramatically. For this trading method:

Currency pair: Any.

Time frame: Any.

Indicator: Stochastic (14, 3, 3)

Entry rules: Buy when the faster moving Stochastic line crosses above and up over slower moving stochastic line.

Exit rules: Sell when the opposite situation (next crossover) occurs and right after that open an opposite position. It is again recommended, once the first touch of Stochastic lines (possible future crossover) has been spotted, to wait until the following price bar on the chart has closed and only then take actions.

Advantages: can give entry and exit rules, easy to use.

Disadvantages: Stochastic is a lagging indicator – with this lines crossover system it can create a lot of false signals. Traders may want to change Stochastic regular settings for each particular currency pair to eliminate as many false signals as possible. Stochastic crossover system is good when used in combination with other indicators.

http://forex-strategies-revealed.com/

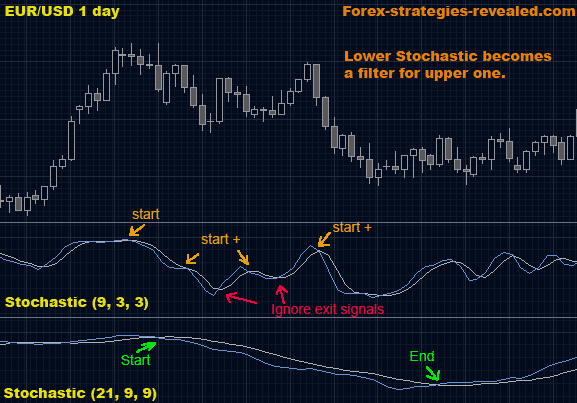

Forex trading strategy #6 (Double Stochastic)

By doubling on Stochastic analysis we are doubling on trading accuracy... However, one should remember that with each new Forex tool added complexity can appear; and a very complex approach is not always good.

Strategy Requirements:

Currency pairs: ANY

Time frame chart: 1 hour, 1 day

Indicators: Full Stochastic (21, 9, 9) and Full Stochastic (9, 3, 3).

Entry rules: When the Stochastic (21, 9, 9) lines’ crossover appears – enter (or wait for the current price bar to close and then enter). It will be the major trend.

Look at Stochastic (9, 3, 3) to anticipate swings inside the main trend and re-enter+ the market again – additional entries. Also ignore the short-term moves Stochastic (9, 3, 3) that signal for exit – do not exit early until Stochastic (21, 9, 9) gives a clear signal to do so.

Exit rules: at the next cross of major Stochastic (21, 9, 9) lines.

Advantages: using two Stochastic indicators helps to see the major trend and the swings inside it. This gives more accurate entry ruless and gives a good exit rules.

Disadvantages: needs constant monitoring, and again we are dealing with a lagging indicator.

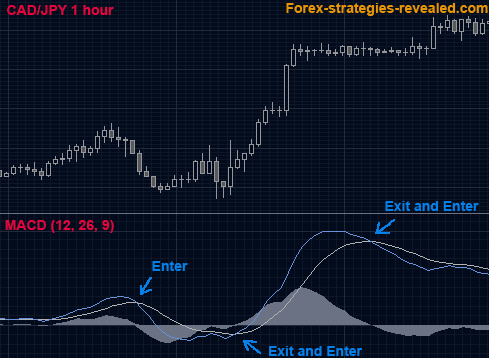

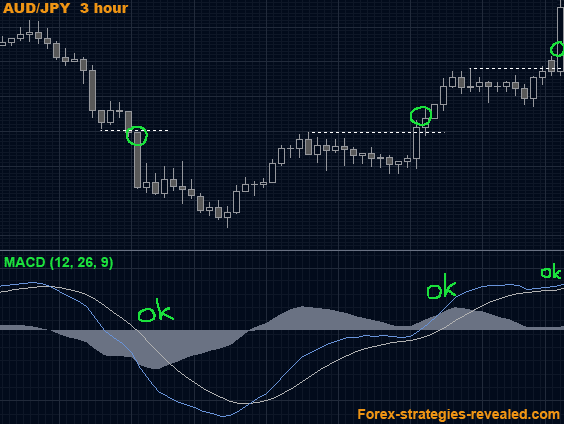

Forex trading strategy #7 (Simple MACD crossover)

Let's take a glance at the very basis of currencies trading with MACD indicator.

We will need only MACD indicator with standard settings: 12, 26, 9.

Any time frame as well as any currency pair can be used.

Entry rules: When the MACD lines’ crossover appears – enter (or wait for the price bar to close and then enter).

Exit rules: when MACD lines next crossover occurs.

Advantages: very simple approach and can give good profitable entries. Traders may want to change MACD default settings depending on the currency and chosen time frame. For example, traders may test next MACD set ups: USD/CHF MACD (04, 07, 16), EUR/USD MACD (02, 03, 20), GBP/USD MACD (02, 03, 04) for different time frames.

Disadvantages: you will need to sit and monitor it again and again. MACD has little use in sideways trading market. It is also never used alone, but rather in combination with other indicators.

To your trading success!

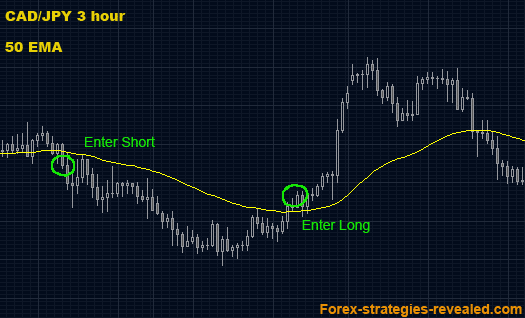

Forex trading strategy #8 (EMA breakthrough)

Sooner or later all Forex traders begin experimenting with different EMA settings.

Quite often very interesting combinations can be spotted. Here is one Simple Forex system based on 50 EMA indicator.

Any currency pair.

Time frame: 90 minute or 3 hour chart

Indicator: 50 EMA.

Entry: watch for 50 EMA to pierce the candle bar and finally close above (to enter Long) or below (to go Short). Enter with the second candle after it makes 5 pips higher than the previous one.

Exit: not set.

Stop loss order: 15 pips below 50 EMA.

http://forex-strategies-revealed.com/

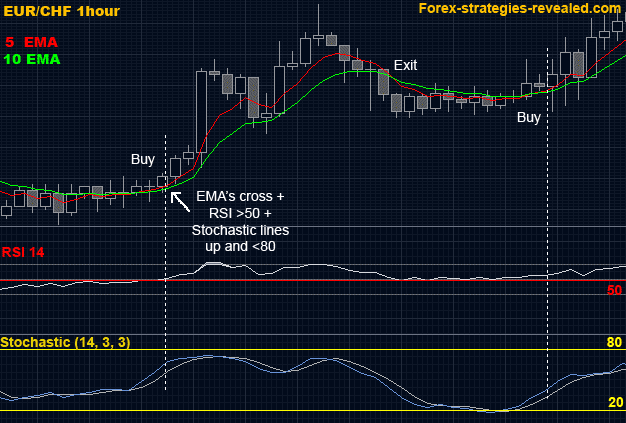

Forex trading strategy #9 (Basic balanced system)

Current Forex trading system represents a well thought and very simple combination of indicators. Knowing what signal to look for with each indicator, provides a strong tip for good entries and exits.

Time frame: Any.

Currency: Any.

Indicators: 5 EMA, 10 EMA, Stochastic (14, 3, 3), RSI (14, 70, 30)

Entry rules: Buy when 5 EMA crosses above 10 EMA and Stochastic lines are heading north (up) and Stochastic is not in overbought position (above 80.00 level) and RSI is above 50.

Entry rules: Sell when 5 EMA crosses below 10 EMA and Stochastic lines are heading south (down) and Stochastic is not in oversold position (below 20.00 level), and RSI is below 50.

Exit rules: when 5 EMA and 10 EMA cross in the opposite direction or if RSI crosses the 50 mark again.

Advantages: allows filtering entries and thus is more accurate.

Disadvantages: 5 and 10 EMAs can give very early exit signals.

http://forex-strategies-revealed.com/

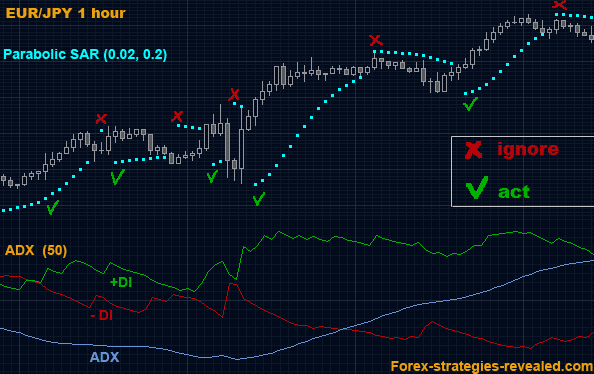

Forex trading strategy #10 (Parabolic SAR + ADX)

The two indicators we are going to talk about here are found to be very well working when used side by side. This Forex trading system is an another simple discovery; and hundreds of such discoveries can be made when traders are there to learn and experiment.

Any currency pair and time frame can be used.

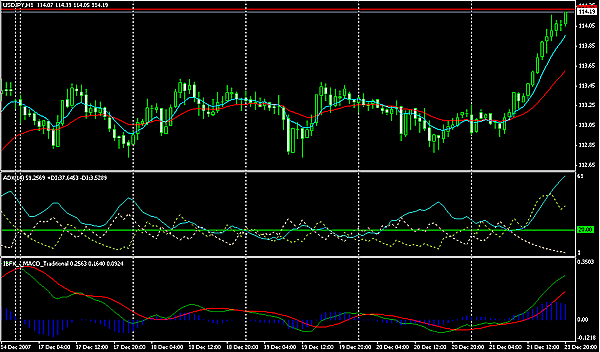

Indicators: Parabolic SAR default settings (0.02, 0.2), ADX 50 (with +DI, -DI lines)

Entry rules: Sell When the +DI line is below the -DI line, and Parabolic SAR gives sell signal. When the +DI line is above the -DI line, all Parabolic sell signals must be ignored.

Entry rules: buy when the +DI line is above the -DI line, and Parabolic SAR gives buy signal. When the +DI line is below the -DI line, all Parabolic buy signals must be ignored.

Exit rules: when +DI line and -DI lines have crossed again.

Also the higher the ADX rising - the stronger the current trend is. If ADX has reached 25, the strong trend is in place.

Advantages: allows filtering entries and predicting good exits.

Disadvantages: Both Parabolic SAR and ADX are follow-up indicators. Although they complement each other very effectively, the “weakest” in chain is ADX, because during trading it can give one signal, but later change to the opposite. Once given a signal from ADX, waiting for the current price bar to close to avoid such misleading is advised.

http://forex-strategies-revealed.com/

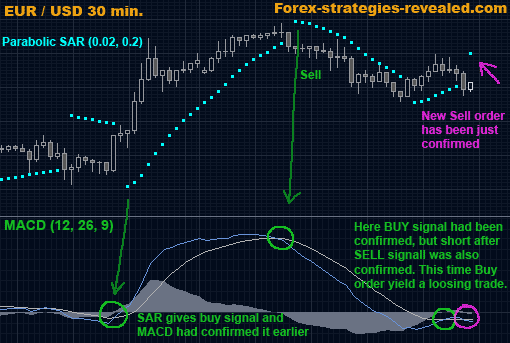

Forex trading strategy #11 (EUR/USD simple system)

As we move forward we discover a strategy that fits only chosen currency pairs.

Take a look at the next Forex trading system:

Currency pair: EUR/USD.

Time frame: 30 min.

Indicators: MACD (12, 26, 9), Parabolic SAR default settings (0.02, 0.2)

Entry rules: When Parabolic SAR gives buy signal and MACD lines crossed upwards – buy.

When Parabolic SAR gives sell signal and MACD lines crossed downwards – sell.

Exit rules: exit at the next MACD lines crossover or if the market starts trading sideways for some time.

Happy Forex trading!

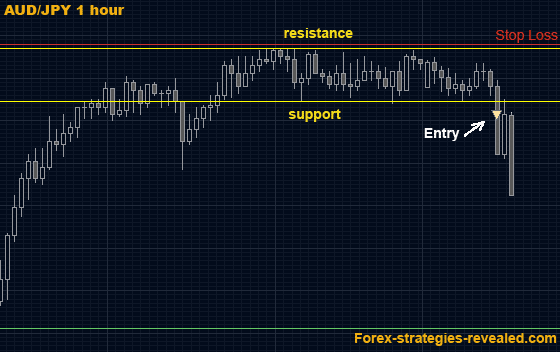

Forex trading strategy #12 (Trend line tunnel)

Creating a support/resistance tunnel on the price congestion and trading on the break of this tunnel is a milestone of Forex trading discoveries.

This trading system/approach needs no indicators and can be applied to any currency and traded in any time frame where coiling in a tight range is spotted.

Entry rules: Find consolidation on the chart and draw two horizontal trend lines – support and resistance. Once the price breaks trough one of the trend lines and a current price bar closes outside the tunnel – buy/sell in the direction of the breakout. (If price pierces the trend line, but did not close outside the tunnel, cancel the previous trend line and draw another one according to the new conditions).

Note: also very often happens that once the price makes it through support or resistance it rocks down/up very quickly and so, more aggressive entry can also be adopted – without waiting for the current price bar to close.

Exit rules: not set, however, it is believed, that the price after breaking the tunnel will travel the distance equal to the width of that tunnel.

Advantages: very simple and extremely effective. It can provide 100% profitable entries if short profits are taken - usually with the close of the first candle right after the entry.

Disadvantages: very accurate and well thought entry point should be picked. Orders placed very close to the tunnel can be triggered by sudden whipsaw early before real breakthrough occur.

http://forex-strategies-revealed.com/

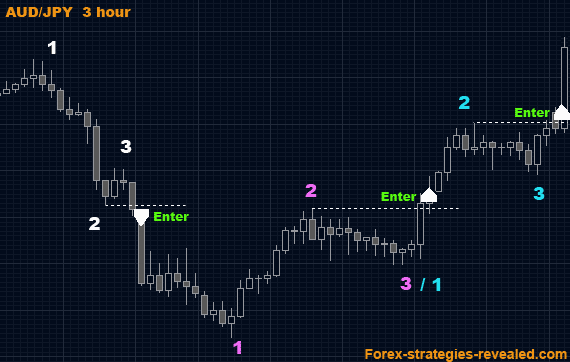

Forex trading strategy #13 (Simple 1-2-3 swings)

And here we are again talking about the strategy that withstood the test of time. This Forex trading method is based on the same study of defining support and resistance levels and trading upon the fact of their violation.

A trading setup requires only an open chart and no restrictions for the currency or timing preferences.

Entry rules: Once the price makes it through the “pivot Line” - dotted white line on the figure below (drawn using the latest price peak) - and closes above (for uptrend) or below (for downtrend) the line buy/sell accordingly.

Exit rules: not set. However, exit can be found using Fibonacci method; or traders can measure the distance between point 2 and point 3 and project it on the chart for exit.

Additions: as an additional tool traders can use MACD (12, 26, 9). The rules for entry then will be next - let’s take a SELL order:

When MACD lines cross downwards, you look for 1-2-3 set-up to form. When the price starts “attacking” the “pivot Line” you check that MACD is still in SELL mode (two lines are heading down). Once the price closes below the “pivot Line” – place Sell order.

Same chart: MACD (12, 26, 9) is added.

Advantages: gives 100% profitable entries.

Disadvantages: does not advise on exits.

http://forex-strategies-revealed.com/

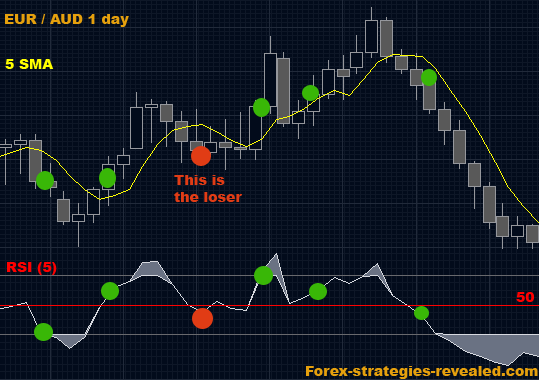

Forex trading strategy #14 (5x5 Simple system)

Just look what this trading strategy has to say. It's a simple yet quite promising Forex trading method. Trading strategies like this can only be discovered through a long and determined observation of the price behavior.

To start:

Currency: ANY

Time frame: 1 day

Indicators: 5 SMA, RSI 5

Entry rules: Buy when the price crosses over 5 SMA and makes + 10 pips up, the RSI must be over 50. Sell when the price crosses below the 5 SMA and makes +10 pips down, the RSI must be less than 50.

Exit rules: not set.

It is a very very simple system, yet with quite impressive results.

Always remember to take actions/enter the trade only after the signaling candle is closed.

This Strategy or trading idea can be used to create more advanced trading version.

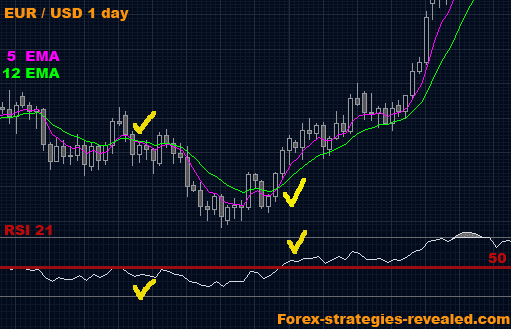

Forex trading strategy #15 ("Key Simplicity")

Yes, one look - one hit. A trader can decide on his/her trading plans by a simple 1 second glance at the chart. It is a very simple Forex trading system that is a pleasure to use for traders with a busy schedule.

Strategy requirements:

Time frame: 1 day

Indicators: 5 EMA, 12 EMA, RSI 21

Currency: ANY

Entry rules: Buy when 5 EMA crosses up and over 12 EMA and RSI is above 50. Sell when 5 EMA crosses down and below 12 EMA and RSI is below 50.

Exit rules: exit when 5 and 12 EMA cross again or when RSI crosses back through 50.

Since it is a daily system the logic behind it can be described as simply following the daily trend. Because EMAs are lagging indicators they actually help us in this case. The signalling EMAs' cross appears after a good pause which is just enough for the new trend (if any) to be established.

http://forex-strategies-revealed.com/

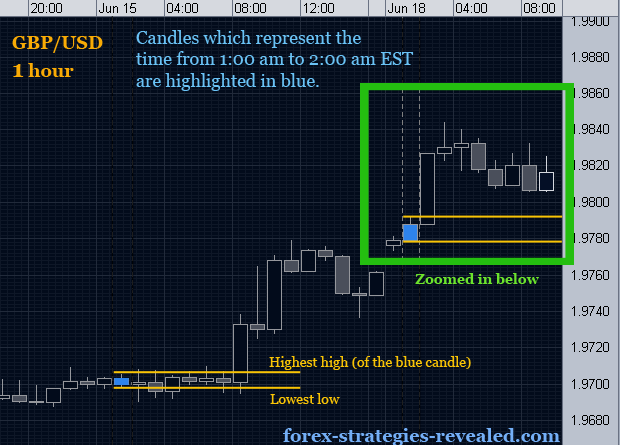

Forex trading strategy #16 (Simple breakout System)

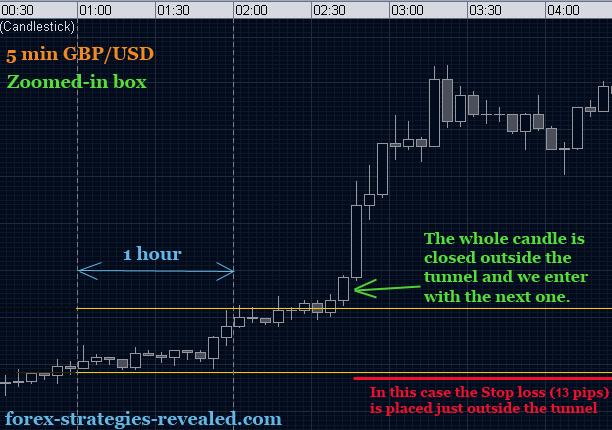

The idea behind this simple Forex trading system is to capture an early move of the price when it starts to establish its new direction/trend for the day.

As we know the Frankfurt market opens at 2:00 am EST (which is 7:00 am GMT), then an hour later the other giant - London market opens at 3:00 am EST (which is 8:00 am GMT). The European session is the first major session for each coming day.

So, what do we do?

We start with 1 hour time frame, preferred pair - GBP/USD and no indicators.

The price range we are going to focus on is from 1:00 am EST to 2:00 am EST.

We look for the highest high and the lowest low of the price in that range and simply draw parallel horizontal lines through those extremes that will create a tunnel.

Now we are ready to move to a smaller time frame - 5 minute chart - and watch for the whole 5 min candle to close outside the tunnel which will provide a signal for us to enter with the open of the next candle.

We use a 20 pip stop OR the other side of the tunnel - whichever is less.

We are aiming at at least 20 pips profit. After that we have several options: lock the profit in, start "chasing" the price with a trailing stop by placing the stop just below the lowest low of the previous 5 min candle, or simply exit within the three consecutive hourly candles from the moment the trading order was filled.

Happy Forex trading!

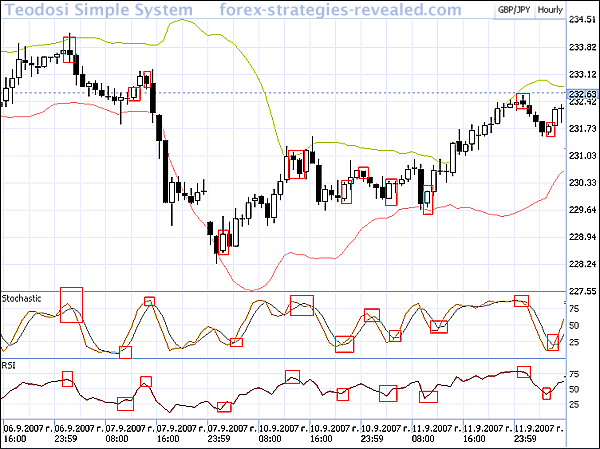

Forex trading strategy #17 (Teodosi simple system)

This Forex system was sent us by Teodosi.

We are proud to have such users willing to share their thoughts,

ideas and systems so that others can learn and trade Forex even more successfully!

Thank you, Teodosi! Your contribution is greatly appreciated!

------------------------------------------------------------------------------------------------

"Hello guys i`ve been using one very profitable system and i want to share

it with all of you. If anyone has any suggestion i`m open to hear something

new to add in it.

This is my system.

I use 1h chart on GBP/JPY with Stoch(5,3,3) and RSI(7). My idea is this ...

I use Stoch and RSI just to define where it is possible to have a breakout.

Then I use most profitable tool I`ve ever tried - I use candlesticks.

If I have strong up trend and my Stoch and RSI are overbought, and we have

down trend candle (black candle) close at the middle of the last

(in this case white one) I enter my trade.

With this system I make more than 1500 pip only from GBP/JPY for week. I just use it for GBP/JPY.

Rules are this:

Sell when RSI and Stoch are bought or they are close to overbought (75)

line, and we have down candle which has closed at least at the middle of the last up

candle.

Buy when we have oversold RSI and Stoch and we have up candle which has closed

at the middle of the last down one.

;) very very very simple and very profitable system

Exit rules if we are in a sell trade and ... we have oversold RSI and Stoch

and we see this up candle which has closed at 50% of the last down one - exit and

enter another trade.

Like I said this very simple and very very profitable

system. O, and I put my stop lost at -100 pip.

I`ll be glad if you post it ... and want to see what folks will say about it ... :)"

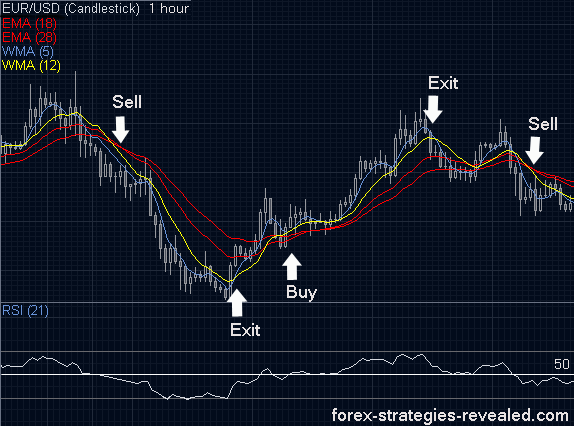

Forex trading strategy #18 (Teodosi Moving Averages' tunnels)

This Forex system was submitted by Teodosi.

Thank you!

We value your great efforts to help us building this free Forex strategies resource

where traders all over the world can find answers about Forex and pick up ideas that

will improve their trading!

-----------------------------------------------------------------------------------------------------------

"Hello guys i want to help all of you and i want to share you some good system.

Like many traders say good system is simple one an that`s why i`ll tell you one very simple.

This is......

- 1H (of 30MIN, but you will get more whipsaws) candlesticks/bar charts

- 18 EMA & 28 EMA (put them in red)

- 5 WMA (in blue) & 12 WMA (in yellow)

- RSI = 21

The 18 EMA & 28 EMA are two red lines who form a tunnel, these will help you to determine

the start of a rend and the end of a trend.

Long term

The 5 WMA & 12 WMA will show you when to enter a trend, they will also

help you to see the strength of the trends. Short term

Entry Signals

You should only open a position, when the red tunnel is extremely narrow or crossed !

LONG: 5 WMA & 12 WMA cross the red tunnel upwards.

If the 5 WMA also crosses the 12 WMA upwards, then the signal is extra strong.

RSI >50

SHORT: 5 WMA & 12 WMA cross the red tunnel downwards.

If the 5 WMA also crosses the 12 WMA downwards, then the signal is extra strong.

RSI<50

Exit Signals

Signals that show the end of the chosen trend

- Long: The price has reached a top and 5 WMA dives under 12 WMA

Close position

- Short: The price has reached a bottom and 5 WMA jumps above 12 WMA

Close position

Always close your position when boundaries of the red tunnel cross eachother

or when they become so narrow that they are one! This is a clear sign of a trend reversal.

After you see this, close your position and open a new position in the other way

(If you were long, close, open a short position)

When in a trade and the 5 WMA & 12 WMA cross the red tunnel ->

Pay attention! As long as the red tunnel boundaries doesn’t cross

eachother there is no problem, but often this is a sign that they will!"

Teodosi

Forex trading strategy #19 (Egudu simple 4 tools trading)

This Forex strategy was submitted by Egudu.

ok guys, here the strategy:

any currency

1hr,

7EMA(blue)

21EMA(red)

ADX(14)

MACD(12,26,9)

enter long once the 7EMA crosses 21EMA up and the ADX has passed it's 25 or 20mark and the MACD is trending up.the other way round is for short position. Note only enter a position once the ADX has passed it's 25mark.

Exit: exit any position once the 7EMA crosses the 21EMA. Also, the MACD should be looked at before entering a trade, when it's consolidating, you should stay away from the trade.

l am egudu.

Egudu,

Thank you from all our users and web team! Your contribution is greatly appreciated!

Edward Revy

http://forex-strategies-revealed.com/

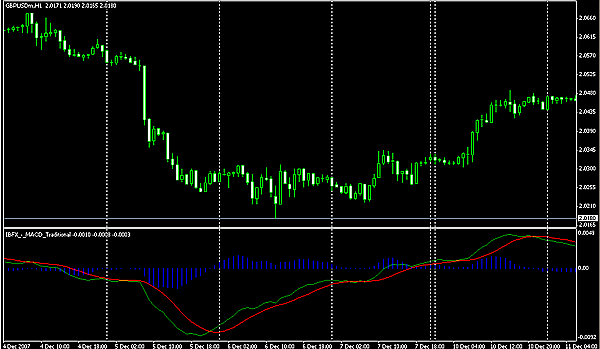

Forex trading strategy #20 (Trading MACD consolidation)

Current Forex strategy was submitted by Egudu - our valued contributor.

I am egudu, and here's another strategy.

It's trading the MACD consolidation.

Time frame: 1hr

currency: any

indicator: MACD(12,26,9)

Entry: place a buy stop and a sell stop 5pips during the MACD consolidation with a stop loss of 10pips from entry and a profit target of 30-50pips.

Please note that, the MACD must be very close, in fact it should almost become a straight line only then should you enter the positions. l hope to give a picture shot of it soon, but u can check the chart of GBP on the 7th, 10th, 14th of Dec 2007 on the hourly chart.

Egudu, thank you once again, and we hope to hear from our users about their tests and trading performance with this strategy.

Edward Revy

http://forex-strategies-revealed.com/

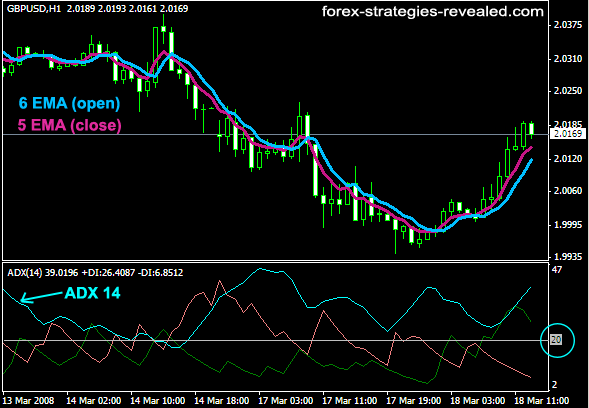

Forex trading strategy #21 (Egudu EMA+ADX Strategy)

The following Forex strategy was submitted by Egudu - our valued contributor. Thank you once again and let the market be always on your side!

Hi, this is Egudu, and i have this simple but efficient strategy and i hope you enjoy using it.

Currency: any

Time frame: 1hr

Indicators: 5EMA(close), 6EMA(open), [ADX(14) at 20mark]

Rule: Enter a long position when the 5EMA crosses the 6EMA up and the width difference between them is a pip and the ADX must be over it's 20mark.

For those conservative traders, you could add 55EMA and 89EMA to know the trend and only enter a position according to the trend,that's enter long when the 55EMA is over the 89EMA and all other parameters are in place as i have stated above.

Additional Forex systems by Egudu can be found at:

http://forex-strategies-revealed.com/egudu-4-tools-trading

http://forex-strategies-revealed.com/trading-macd-consolidation

Forex trading strategy #22 (H4 Bollinger Band Strategy)

Current strategy was submitted by Joe Chalhoub.

Thanks Joe, and happy trading to everyone!

H4 Bollinger Band strategy

Tools : Bollinger Bands(20)

TimeFrame : H4

Currency : ALL

This strategy is extremely simple and I use it to detect opportunities and it is very good.

If you open an H4 EUR/JPY chart and you insert the Bollinger Bands(20) indicator, if you observe the chart you will see that the bands are simply a Resistance and Support. The Upper band is a Resistance and the Lower Band is a Support. If you pay attention to the chart you will see that most of time the price hit the upper band then it retraces back to Lower Band, so how I trade is very easy, I wait till the price touches let’s say the upper band and closes under it (not above it) and wait till the candle is formed, when it finishes and the next candle opens under the previous Upper band then I enter a Short trade with target = 100 pips or until it touches the Lower Band.

Same thing when it touches the Lower band and the candle closes above it, and the next candle opens above the previous Lower Band then I go Long with Target = Upper band or 100 pips. You can develop this strategy as I did, and you can profit a lot, I made more than 800 pips this month.

You can check my website for any further help http://rpchost.com . If you think in this technique and observe the chart I am sure you will develop this strategy quickly and make 99% winning trades.

Good Luck.

Forex trading strategy #23 (GBP/JPY Breakout Strategy)

Alternative strategies collection

Under this topic we will be posting files with Forex strategies submitted by our readers.

These strategies are not exclusively ours, they were found by users on other Forex websites. Nevertheless, strategies offer interesting approaches and trading ideas for everyone to test and trade upon.

Happy trading!

| Attachment | Size |

|---|---|

| weekly_scalping.doc | 21.5 KB |

| 95pips_strategy.doc | 27.5 KB |

| GBPJPY_breakout.doc | 20.5 KB |

Forex trading strategy #24 (GBP/USD breakouts)

Credits to James Ayetemimowa - our valued contributor!

GBP/USD

when it is 1 hour to london open, draw lines on the highest high since midnite and lowest low since midnite, just trade the breakout and let ur stop loss be at the high of the candle that broke the low line for short trade and the low of the candle that broke the upper line for long trade

if u experience a breakout before New York Open, please target the first 30pips

if beyond New York Open before a break please target between 10 to 20 pip

Happy Trading!!!

Forex trading strategy #25 (H4 Bollinger Band Breakouts) more to come...

Insert the Bollinger Band (20) indicator and be sure that its center line is appearing.

Identify 2 valid lower points OR 2 valid higher points in the Bollinger Band and drop a line from the first to the second line; it will be our break line.

Now when a candle closes above the break line issued from the higher points and in case the center line of the Bollinger band in the 1 hour chart crosses the break line then we have a LONG Trade.

If the candle in the 4 hours chart closes under the break line issued from the 2 lows points and in same time the center line of the Bollinger band crosses the break line in the 1 hour chart, then we are in a SHORT trade.

1 comment:

Content re-published from: http://forex-strategies-revealed.com/

Post a Comment