Along with Forex complex trading strategies this page is expected to gradually reveal our so called Forex advanced trading strategies.

These strategies will have a strong background, sound theoretical base and will represent known to us trading techniques and rules used by experienced Forex traders. We also going to share trading strategies that we use in our Forex trading practice.

Don't forget to read our disclaimer policy.

Also remember that any trading involves risks and there is no trading system which is immune to losses. Your experience may easily start with a losing trade, so before giving up on a system, make sure you've tested it well.

Your discipline is and will always be the key to success. Follow the rules strictly, if modified, write these changes down and do not alter as you trade.

It is promised to be a good experience!

However, there will be no miracles. Those strategies will not be revolutionary Forex strategies of all times or some "Holy Grail" systems to bring you millions, at least we cannot promise that.

What we can promise is that there will be a lot of stuff to learn and ideas to try out.

Advanced system #1 (Midnight setup)

Ready to dedicate your midnight hour to Forex trading? This strategy can be your winner.

Trading strategy setup:

Currency pair: GBP/USD or any other.

Time frame: 1 day. No indicators.

Trading Rules:

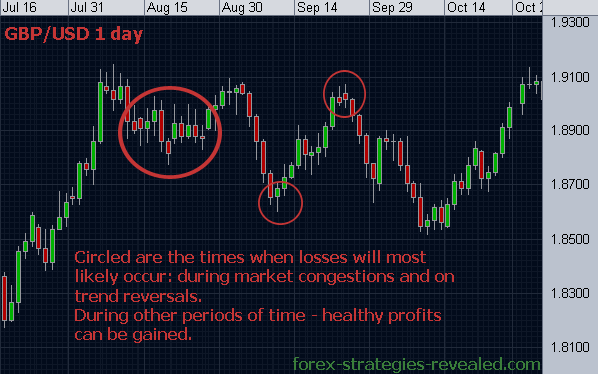

This system is based on the fact that most of the time you will not find same size candles for 2 consecutive days on a daily chart. What does this mean for us – only one thing: the price is moving steady either up or down with no price “noise” which is always present on smaller time frames.

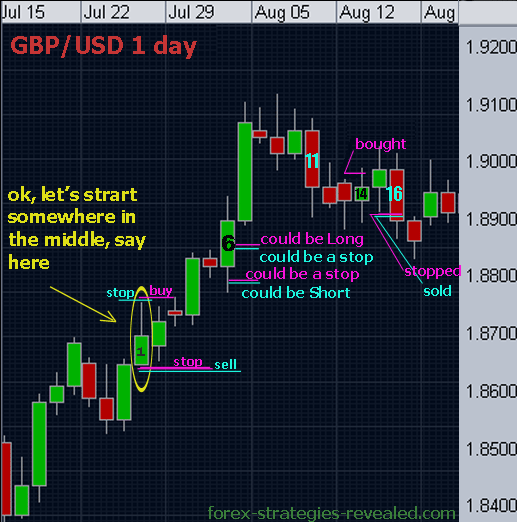

At 00:00 (your local time) or rather: according to the time set on your trading platform, with newly formed daily candle find highest and lowest price of the day for the previous daily bar.

If the price bar (including shadows) is less than 90 pips long we will not open new trades on the next day. (This is our requirement for GBP/USD pair, it can be changed/adjusted for other currency pairs).

If trading can be done, set Buy stop order at the top of the highest price +5 pips and Sell stop order at the bottom -5 pips.

Put your stop loss order for a Long entry at the lowest price for the day -3 pips.

Put your stop for Short order at the top of the highest price for the day +3 pips.

These additional pips for entries and stops can also be adjusted once a behavior of chosen currency pair is learned over the time.

Now, when one of the orders is filled – stay in the trade for the whole day. At midnight with the new daily bar open, adjust your orders and stops according with the previous daily bar following the same routine; keep trading position open until get +100 pips, then you may close current position to reward yourself. Rewarding is a very powerful tool, use it.

Also close you current position (with either profit or loss) if a daily candle becomes a Doji candle or is almost a Doji. What we mean by “almost” is that for the true Doji you need open price = close price, while “almost Doji” can have some distance between open and close (but no more than 10 pips).

For example: on May 1st at 00:05 am, we opened a daily chart and it was a downtrend. We set our orders: both Buy and Sell according to the previous candle (April 30th). The same day our Sell order gets filled. The day has passed and the price made some further progress down. At 00:05 am May 2nd with a new daily candle appearing we change our stop loss for our current Short position according to the high of the previous bar (from May 1st) and we either continue to stay in the trade or lock in profits. Also we reset our Buy order which is now going to be just above the highest high of the May 2nd price bar.

This system also gives an opportunity to be constantly in trade and at the same time it requires very little observation and takes only 5 minutes to set all positions and forget about Forex till the next midnight. You will see losing trades with this system from time to time – it is a part of any trading, but the overall result will be very positive.

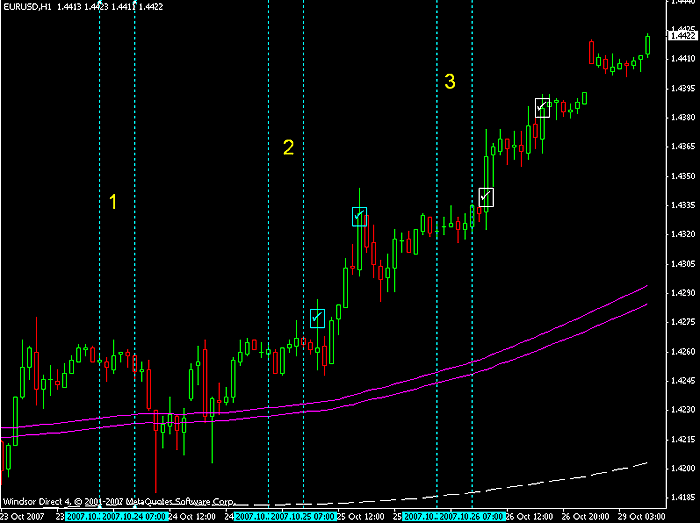

Let’s look at the same chart in more details.

Next is a detailed candle-by-candle explanation of the trading on the chart above.

We will number candles starting form 1 – so number 1 is a circled candle.

1 st candle (high – low = over 90 pips) - allows entries next day. We set orders.

2st candle – the price didn't get above or below the 1st candle, no orders filled. Midnight: 2nd candle is over 90 pips long, so we reset orders according to 2nd candle’s high and low.

3nd – buy order filled. Midnight: day ended negatively, but didn't trigger the stop loss, we keep our position open and adjust stop loss below the low of the 3rd candle and minus additional 3 pips. The 3rd candle is also less that 90 pips long and we wouldn’t trade the next day except that for now we have already one position running.

4rd – went in profit and we rewarded ourselves closing position at the end of the day with just over 100 pips (you can actually set your target lower than that, and use 100 pips as a suggestion).

Choosing a profit target for the day becomes easier when you know a daily range average for a particular currency pair.

For example,

GBP/USD daily range average is 180-200 pips

EUR/USD daily range average is 110-120 pips

USD/JPY daily range average is 80-90 pips

USD/CHF daily range average is 120-130 pips

Taking about a half of it can determine your profit targets.

5th – no trading as the price didn’t exceed previous candle boundaries. Midnight: candle #5 is less than 90 pips, thus we are not setting any orders for the next day.

6th – we didn’t trade it and for a good reason – price managed to get below and above the previous candle’s high and low, which could mean for us hitting our stops, in worst case - twice.

7th - we had our stop loss below the low of candle 6, this trade is a reward again – more than 150 pips, so we lock it... and for a good reason...

We will have systems that will be able to easily allow trades running their positions further relatively safe, but for this one it is important to lock your profits – the reason is that we move our stop order every day.

8th – no trading opportunities. Midnight: candle 8th is less than 90 pips means we are not going to trade next day.

9th - no trading and we were very right about it. Midnight: 9th candle is long enough for us to set targets for the next day.

10th – no orders triggered. Midnight: 10th candle is long enough again which allows us to reset our orders.

11th – we sold, the day ended in profit, but the profit was relatively small, so we are going to stay in trade.

12th – brought us 100 pips at the end of the day and we go out taking profits. Also we reset orders for tomorrow.

13th – Long order was triggered and price made some progress during the day, but closed almost at the same level. We stay in and adjust our stops.

14th - our stop loss is hit and moments later buy order is filled. The price closed below our order, we stay in trade.

15th – we are almost at breakeven, but nothing to earn, we stay in trade.

16th – brings us loss again as our stop loss is hit; a short position is filled soon after and so on...

Happy trading!

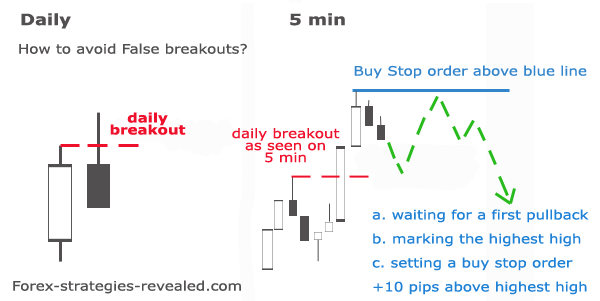

Advanced system #1-a (Midnight setup addition: Trading Breakouts of the Breakouts)

Current trading method was developed as an addition to original Midnight Setup strategy, but can also be traded alone or in combination with any other Forex strategy.

The idea is to filter out some big portion of false breakouts in our case above/below daily candles.

Setup: daily charts and 5 min charts, no indicators.

Entry rules:

Using rules from Midnight Setup strategy we get ready to enter on the break of the daily candle's high or low.

However, this time instead of placing Buy/Sell stop orders above/below daily candle, we aren't placing any, but rather waiting for actual breakout to occur. Would be a good idea to set an alert signal on a trading platform that will call us when the first breakout is in place.

Immediately after a breakout above/below daily candle on daily charts we go to 5 min charts, where we wait for the price to finish its first advance and start retracing back.

Here comes the idea of Trading Breakouts of the Breakouts:

On 5 min chart we mark the very first extreme level set by the price (highest high or lowest low depending on the breakout direction) and place Buy Stop or Sell Stop orders +10 pips above/below that extreme. This way our order will be triggered only if the price confirms its directional intentions... Otherwise, it was a false breakout.

Quite often after the breakout on Daily charts, 5 min charts first extreme point reveals the real nature of the breakout. Price may never reach that extreme again, or it can come and make double top/bottom pattern and back up. Not all but many losing trades can be avoided by Trading Breakouts of the Breakouts.

Along with advantages, there are some not very critical disadvantages of this method:

First of all, we are going to enter a bit later after the initial daily breakout and thus will definitely miss some pips from the starting breakout point.

Second, if the breakout is extremely powerful, our 5 min retracement may never come or come way too late. Chances for that are quite small, usually there is always something to spot on 5 min charts, but exceptions may occur.

Third, you can't set it once in the morning and forget about it for the rest of the day. You need to be there to spot the first 5 min retracement and set appropriate orders.

Happy trading!

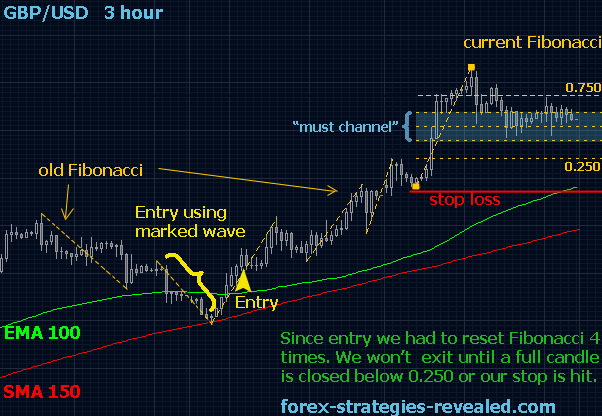

Advanced system #2 (Fibonacci trading)

The fact that Fibonacci numbers have found their way to Forex trading is hard to deny.

Moreover, trading currencies with Fibonacci tool for many traders have become the bread and butter of their whole trading career.

So, shall we look at the one of such good Forex trading systems today?

Trading setup and tools we need:

Time frame: 3 hour (or 4 hour).

Currency pairs: any.

Indicators:

Fibonacci tool - our main tool

EMA 100 – green (visual guidance)

SMA 150 – red (visual guidance)

RSI (14) on a daily chart

We will be working with next Fibonacci retracement levels: 0.382, 0.618, 0.250 and 0.750.

Default stop loss – roughly 100 pips and then adjusted according to the most recent swing high/low.

Profit target – no target is set as we will let the profits run.

Trading Rules:

Find the closest to the current price wave with a distance from High to Low over 100 pips.

Apply Fibonacci on it no matter if the wave is going up or down, only size matters.

Some terms we are going to use here:

The corridor between 0.382 Fibonacci retracement level and 0.618 retracement on the chart – will be called a “must channel”.

Fibonacci retracement levels will be numbered always from bottom to top, no matter whether it is an up or a down wave. E.g. at the bottom we will always have 0.250, then next 0.382, 0.618 and finally on top – 0.750 Fibonacci retracement level.

Entry rules:

Always enter only according with both:

1. EMA and SMA trend suggestion (e.g. green on top – uptrend, red on top - downtrend)

2. RSI suggestion (e.g. reading below 50 – only sell orders, above – only buy orders).

Now, after applying Fibonacci on a wave bigger than 100 pips we wait for the price to go inside a “must channel” area (at least to make 1 pip into the channel). Only then next rules will be valid:

- If a full candle (including shadows) is closed below 0.250 Fibonacci retracement, we go short. If we are currently long – it is time to close long position – it is an exit rule as well.

- If a full candle (including shadows) is closed above 0.750 Fibonacci retracement, we go long. If till this time we had short positions open – we close them – and again it is an exit rule as well.

Important: once another wave greater than 100 pips occur, set a new Fibonacci on the new wave. Retracement levels will change and so we will now follow new retracements.

(Optional: for visual aid traders may mark old Fibonacci wave to see the general pattern of consecutive waves on the chart).

That’s it. Stay in trade, resetting Fibonacci with each new wave and moving a stop loss according to the last swings high or low (in simple words, a stop loss will be always just below the Fibonacci 0% line) until it is time to close the position according to our rules.

This strategy prevents a lot of “bad” entries, eliminates early exits and allows staying in trade for a long period of time helping to take everything a current move can offer.

Traders may close all good winning positions on Friday evening if they prefer not to hold them over a weekend.

To your trading success!

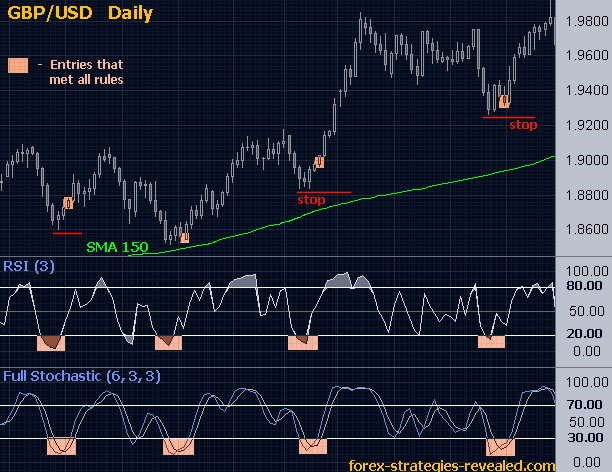

Advanced system #3 (Neat entry: RSI + Full Stochastic)

Current strategy has won the hearts of many Forex traders. And why not when it has a great winning potential.

Strategy requirements/setup:

Time frame: daily

Currency pair: any

Trading setup: SMA 150,

RSI (3) with horizontal lines at 80 and 20,

Full Stochastic (6, 3, 3) with horizontal lines at 70 and 30.

Trading rules:

Entry for uptrend: when the price is above 150 SMA look for RSI to plunge below 20. Then look at Stochastic - once the Stochastic lines crossover occur and it is (must be) below 30 - enter Long with a new price bar.

If at least one of the conditions is not met - stay out.

Opposite for downtrend: when the price is below 150 SMA wait for the RSI to go above 80. Then if shortly after you see a Stochastic lines crossover above 70 - enter Short.

Protective stop is placed at the moment of entry and is adjusted to the most recent swing high/low.

Profits are going to be taken next way:

Option 1 - using Stochastic - with the first Stochastic lines cross above 70 (for uptrend) / below 30 (for downtrend).

Option 2 - using a trailing stop - for an uptrend a trailing stop is activated for the first time when Stochastic reaches 70. A trailing stop is placed below the previous bar's lowest price and is moved with each new price bar.

This strategy allows to accurately pin-point good entries with sound money management - risks/protective stops are very tight and potential profits are high.

Current trading strategy can be improved when it comes to defining the best exits. For example, once in trade traders may also try applying Fibonacci studying to the most recent swings. This way they can predict short-term retracements and make sure they will not be pulled out of the trade early and will continue pursuing profit targets at Fibonacci extension levels.

Profitable Forex trading to everyone!

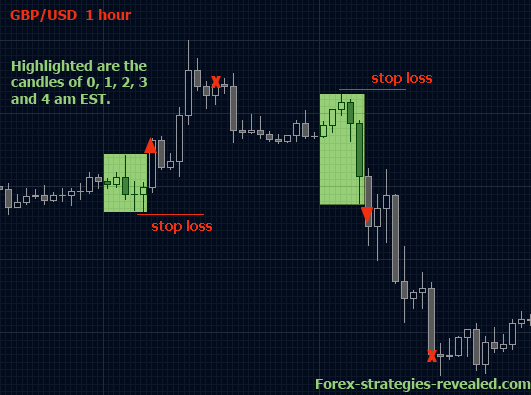

Advanced system #4 (Early bird Breakout System)

Another advanced morning strategy tightened to the timing factor and only two currency pairs.

Trading setup:

Time frame: 1 hour.

Currency pair: preferred but not limited to EUR/USD and GBP/USD.

This Forex breakout system uses no indicators.

Trading rules:

The system is called "early bird" because it requires a trader being ready to trade Forex as early as 5:00 am EST.

Find the Highest High and the Lowest Low for the candles from 00:00 EST to 4:59 am EST. (We should have 5 candles for each hour: 0, 1, 2, 3 and 4).

At 5:00 am EST set 2 entry orders: buy order - above the highest high +5 pips, sell order - below the lowest low and -5 pips.

Set initial profit target to +90 pips for EUR/USD and +140 pips for GBP/USD - both targets are way too high if to consider that daily range average for EUR/USD is only 110-120 pips and daily range average for GBP/USD is 180-200 pips.

If those targets get hit - very good! However, our profits will be determined mainly by the time factor instead of a fixed amount of pips.

So, we close all open positions at 12:59 EST (1:00 pm EST) and cancel all remaining orders. The next trading opportunity - only next day at 5:00 am EST.

Setting Stop Loss orders:

Stop loss for Buy order should be placed below the found earlier lowest low -3 pips, for Sell order - above the highest high +3 pips. If a stop loss is hit most likely traders will see an opposite position open. Stop loss should never be moved.

To your trading success!

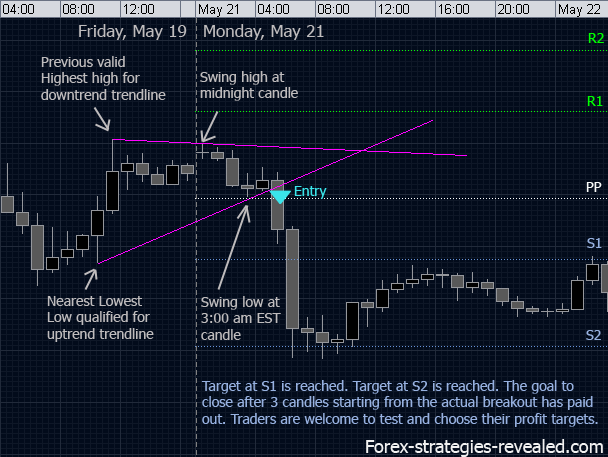

Advanced system #5 (Trend Lines Breakout System)

Breakout systems like this are always in great demand. It is quick, easy and with a proper use has a true winning rate of over 90%.

Currency pair: GBP/USD, EUR/USD - tested. Other pairs may also be used.

Time frame: 1 hour.

Indicators: none.

Trading setup:

For this Forex system to work properly a trader needs to know the basics of identifying swings high and low, rules of drawing trend lines, plus be able to use Pivot Points.

These are very simple things we believe every trader should know.

Our working range includes 5 candles: from midnight to 4:00 am EST (including the 4:00 am candle).

Optional: draw a midnight vertical line for visual aid.

Within those 5 candles look for a valid swing high and a swing low of the price.

Draw an Downtrend trendline connecting a found swing High to the most recent swing High of the previous days. (Make sure the last one is valid High to draw an Downtrend trendline through it).

Do the same for the swing Low: connect it to the most recent swing low of the previous days, make sure you are pulling the right trend line using the rules of drawing Uptrend trendlines this time.

If a trader sees, for example, no Swings High in the 5-candle range, that means there will be no downtrend trendlines this morning.

The Entry is on the break of either one of the trendlines and is immediate without waiting for a current candle to close. A protective stop is placed just above/bellow the candle that broke through the trend line.

Profit target:

Usually the whole action is unfolded within the next three candles (count in the candle that had violated the trendline but only if it closed on the other side of the trendline).

So, after the actual breakout we have 3 hours or 3 candles to trade, after that we will exit with whatever profits are made.

Main rule: Using Pivot points + timing

Profit target is going to be the nearest level of support or resistance according to Pivot point levels.

If, however, after only one candle this target is reached, it suggests a very strong market, thus we would stay in trade and set the goal for the next support/resistance level. We would also choose the second Pivot point level of support/resistance as our profit goal if the first Pivot level appears to be too close to our entry point.

We have three candles to trade after the breakout, that's why we can trade calm and allow our goal to shift to the next Pivot Point level.

It is an absolute traders' discretion of whether to set the target at the nearest Pivot point support/resistance level and leave the trade once the target is hit or using a timing factor exit after the two / maximum three consecutive candles.

Tip: running two orders can save lots of nerves. First target - the nearest Pivot point support/resistance level. Second - on the close of the third candle.

Another simplified option would be with fixed targets and timing

For example, EUR/USD target = 20 pips - spread, GBP/USD = 40 pips minus spread. These are only suggestions, and for other currency pairs = testing will tell...

Hold position open for the next three candles.

If the target is not reached within those three candle, close all trading positions anyway.

That's it. Simple and very effective.

Happy Forex trading!

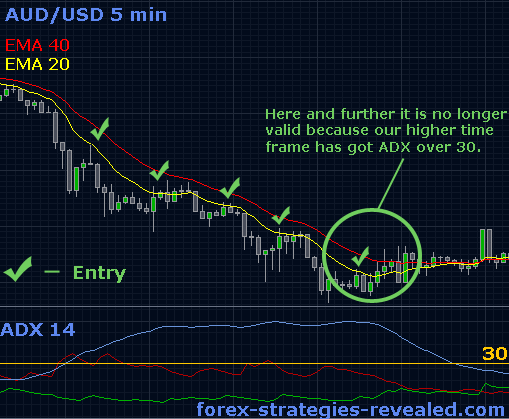

Advanced system #6 (Picking Tops and Bottoms)

Were you told not to hunt for tops and bottoms when trading..?

Why not break the rules when you can tell with an astonishing precision where the next top or bottom will be?

Here is one very nice and accurate trading system that could make your Forex trading entirely about hitting the right spots.

Trading setup:

Time frames: 5, 15, 30 minutes, 1 hour, 3 hour and 1 day – just one chart at the time will be used.

In case you do not have the exact time frames, simply substitute them with the closest ones. For example, 15 min can be changed to 10 min, 3 hour can be changed to 4 hour etc.

20 EMA and 40 EMA on all time frames

ADX 14 for all time frames.

Currency pairs: any.

The idea behind this Forex method is that ADX helps to measure the strength of the trend while 20 EMA acts as a flexible support-resistance line.

Trading rules:

Our first goal is to find the chart with ADX being over 30 mark, which will indicate a strong trend. We start with a daily chart and continue the search moving downwards (3 hour, 1 hour, 30 min, 15 min, 5 min) until we find the chart with ADX being currently over 30.

Note: In case several time frames meet requirements for ADX, we opt for the highest time frame. That's why we start with the highest frame first.

Having chosen the time frame, we are ready to trade the first bounce off of the 20 EMA. We set a limit order close to 20 EMA accordingly: in a downtrend we expect the price to touch 20 EMA from below, then reverse and move down, in an uptrend – from above, reverse and move up.

Always make sure that at the moment of entry you are using the highest time frame with ADX currently over 30. Only then you can expect the price to obey 20 EMA.

That's it.

Initial Stop loss order is placed above (when short) / below (long) the 40 EMA.

Important note: once in the trade stay with the time frame used for entry.

Risks: looking at the charts traders will find that at times the price reverses exactly at 20 EMA, but sometimes it moves even further before making a u-turn. Always be ready to leave some room for the price to make this turn, that's why we suggest using 40 EMA for stops.

Exit rules:

Option 1: Use Bollinger Band with settings (18, 2) for all time frames. Set a profit target at the outside band. Move your profit target as the Band expands or narrows.

Option 2: For traders familiar with Fibonacci tool, profit target can be set to 1.618 expansion level. AB Swing for Fibonacci should be found from the earlier price moves and the actual point of entry should be considered as point C or a retracement.

Option 3: Once the price clearly moves in your favor move the stop below/above (Long/Short trading) the previous price bar. Adjust the stop with each new price bar. Trade until stopped.

Also exit always if ADX goes below 30 on the time frame which was used for entry.

That’s it. Test it and see that it works remarkably well.

P.S. Accuracy of this strategy is quite difficult to backtest/visualize using historical data. If you decide to do so, make sure you do it right and know what time frame should have been chosen for trading at any given time. The easiest way to analyze current strategy performance is by running it in real time.

Happy trading!

Advanced system #7 (EUR/USD breakout system)

We've created a new page for discussions of the new Forex System that was kindly posted by our Visitor. Thank you for taking time and efforts to share this Forex system with us!

-----------------------------------------------------------------------------------------------------------

What is ur comment on this similar system

time frame 1 hour

ema(144) and ema(169) and sma(400)

System uses highest high and lowest low of candles from 1.00 GMT to 6.00 GMT

conditions needed to make trade:

1- Entry price must be away from Vegas tunnel and/or SMA(400) at least 35 points (rebound zones)

2- Orders are set after the close of candle 6.00 GMT

Put buy stop order at the highest high + 5 pips

Put sell stop order at the lowest low - 5 pips

Stop loss orders are put at lowest low - 3 pips and at highest high + 3 pips consecutively

Limit orders = stop loss count value + 15

http://img89.imageshack.us/img89/1611/ddzd5.gif

Pair Eur/USD

chance 1

no short orders because price is near vegas tunnel

Long order was not taken on 1.4267+5=1.4272 because it is not hit

Chance 2

No short orders again for same reason

Long order was taken on 1.4276+5=1.4281

stopp loss =1.4247-3=1.4244

limit=(1.4281-1.4244)+15=52 pips

limit is at 1.4281+52=1.4333

Chance 3

Short order was not taken as 1.4315-5=1.4310 was not hit

Long order is taken as 1.4338+5=1.4343 was hit

entry: 1.4343

stop loss at 1.4315-3=1.4312

limit= (1.4343-1.4312)+15=46

limit is at : 1.4343+46=1.4389

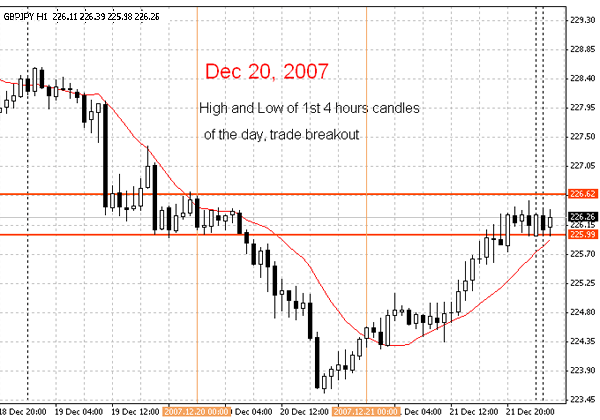

Advanced system #8 (4 CANDLES STRATEGY) more to come...

The following strategy was submitted by James Ayetemimowa.

Thank you, James, for your great contribution!

CURRENCY PAIR - GBP/JPY

4 CANDLES STRATEGY

- Draw horizontal lines on the highiest high and the lowest low of the first Four candles of the day.

- Trade the Valid Breakout of the eigther lines.

- Check Stochastic Slow on 4hours Time frame.

- Trade the direction of the 4hours stoch with higher quantity

- Trade direction against 4hours Stoch with lesser Quantity

- Target the first 50-100pips

- Your stop loss should be the other side of the tunnel

- If your stop loss is hit, set the pending order again.

- Close all pending orders by 5 hours to close of the day.

GOLD

- Plot the Pivot first

- Check the relationship between the pivot and the opening price

- Place Stop Buy 200pips above previous day close and Stop Sell 200pips below Previous day close

- Plot the -+200 above and target the next 200pips or next pivot, whichever is lesser

- A day where the opening price is at the middle of a pivot and a middle pivot, please don’t trade the -+200 consider NO TRADE or wait for price to hit middle of pivot or pivot then apply -+200 from that point.

- Note and Note, any of such potential trade after you must have made your 200pips, you must always lock profit to 100pips b4 you can let it run.

James Ayetemimowa (femjam78 at yahoo.com)

http://forex-strategies-revealed.com/

2 comments:

The Hot Forex signal will present you the objective to enter any trade to add going on your trading platform upon an accurate currency pair signals gone actual epoch. Follow our forex signals and make a large amount of getting within a no evaluate quick time.

Let Visit For forex signals

Best Forex signals and Mt4 Trade Copier service provider is Forex Signals Es. Our Forex signals service and Trade copier service is 80-90% accurate. Use our most accurate forex signals with Trial Signals - 10 Days and Starter Trade Copier - 60 Days.

Post a Comment