Yes, true scalping involves risks as well as any other type of trading.

But if done correctly Forex scalping provides an additional degree of risk management as a result of holding trading positions for a very short period of time as well as constant monitoring of the price and collecting quick profits as they appear.

Please, do not forget to read our disclaimer policy. In short, Forex scalping systems you find below if used will assume trader's own risk and full responsibility.

Scalping Forex is fun. Learn it and trade profitably!

Best of luck in scalping the Forex!

Scalping ideas (ADX and Bollinger bands)

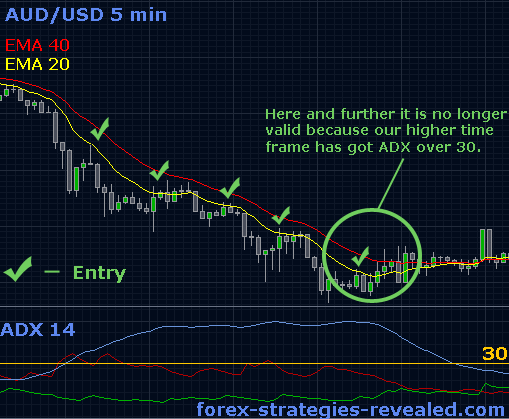

Scalping with the help of ADX:

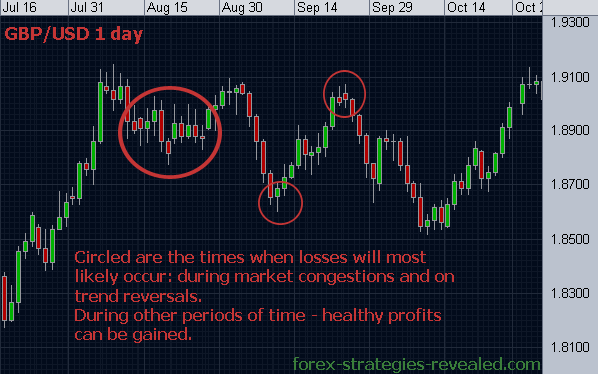

To scalp effectively with minimum time spent, Forex scalpers need to know when the market is trending well and when there is nothing to wait for.

To find out about the strength of the market trend use ADX (Average Directional Index) indicator.

ADX does not show the direction of a current trend, it only shows the strength of the trend. Reading below 20 indicates a weak trend, reading just above 20 – gaining new strength trend and reading above 40 – very strong trend.

It is that simple – scalping is weak when the market is weak, when ADX deeps below 20 – opt for other life activities, do not sit and waste your time in Forex.

Scalping with the help of Bollinger bands:

Bollinger bands can help determine trends and especially upcoming trend reversals.

When price moves outside the Bollinger bands it is suggests a continuation of the current trend, while bottoms and tops made outside the Bollinger bands change to bottoms and tops made later inside the Bollinger bands suggest upcoming trend reversal.

Scalping system #1 (Economic news releases)

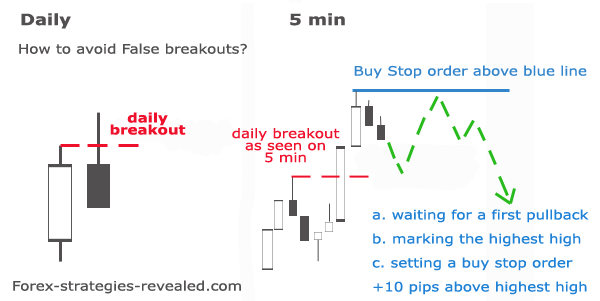

Look for the important news to be released. Choose the most influential ones that are expected to shake the market well. Once got news (last can be found in any Forex economic calendar) find out which currency pair is going to be affected.

Now, 15 minutes before the data is released place buy/sell stop orders on both sides 15 pips away from the current price. Half an hour prior to the big news Forex market usually flats out – no significant trading is done, currency is often “stuck” in a small tight range.

When important news is released, the currency will move easily, producing large pip movements in either direction. Using this scalping strategy, traders will be able to get in and out of the trade in seconds at almost zero risk.

After studying for a while a particular currency pair and its reaction to the news, traders can predict direction of price spikes and the length of the move in pips to set entries and profit targets more accurately

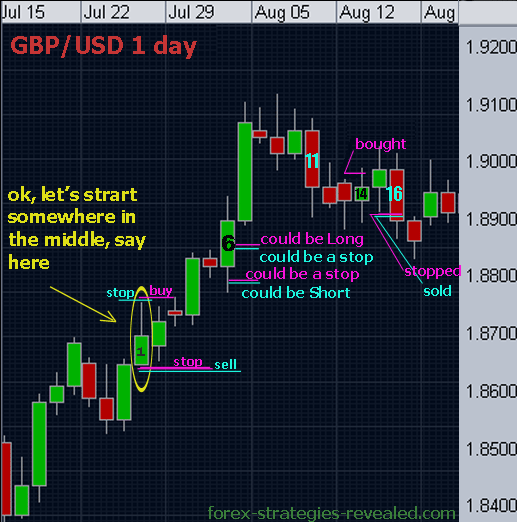

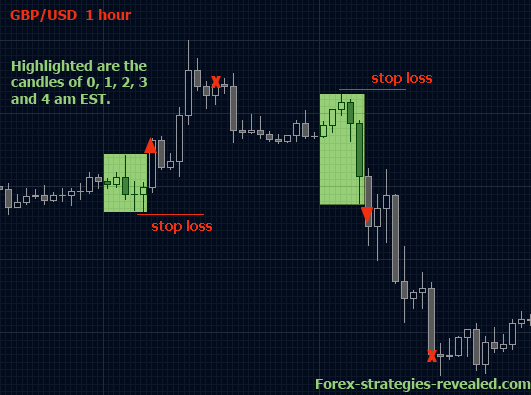

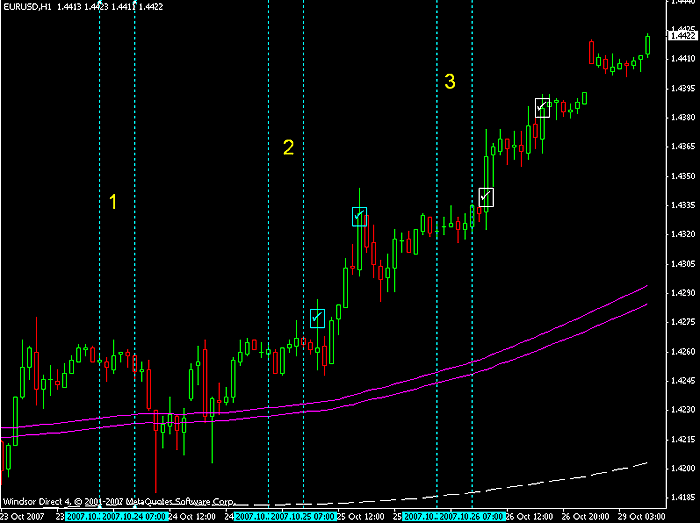

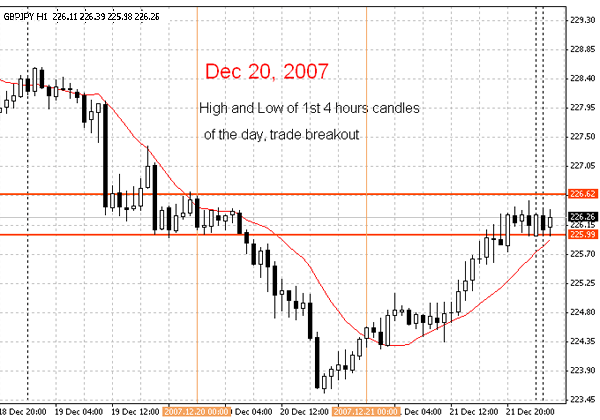

Scalping system #2 (Morning breakouts)

The closer time gets to 8:00 EST in the morning the less movements can be seen on the chart. It is a well known fact that once the Forex market “hears morning bell” at 8:00 am it is going to really move – stretching well doing morning exercises :).

What is needed from traders? Only to place 2 orders: above and below the last candle’s high and low at 8:00 am EST and join morning stretching having your 5 pips safely.

This is a scalpers’ breakout method, for which waiting long is a losing of precious time. If you want to join big traders your buy/sell orders must be above and below the price range created from midnight to 8:00am EST.

Currency pairs: EUR/USD, GBP/USD.

http://forex-strategies-revealed.com/

Scalping system #3 (2 SARs to go)

Be prepared to watch the price constantly. Monitoring the price is not an easy job.

Trade the most active hours – London and New York.

EUR/USD 5 min

GBP/USD 5 min

(optionally may also trade AUD/USD)

SAR (0.01, 0.1) – on the chart

SMA 8 – on the chart

MACD (5, 8, 9) + SAR (0.01, 0.1) on this MACD

Forex scalping with SAR

SAR defines whether we go short or long. We will take only one type of trades according with SAR signals.

Whichever SAR gives earlier signal – we take it. (Sometimes it can be “chart-SAR”, sometime “macd-SAR”)...

Trading Rules:

When we talk about “trend change” we mean small tiny trends that are actual for us scalpers on 5 minute chart. We do not want to know what is going on 15 min, hourly or even more so daily chart.

With the first SAR dot appearing on the opposite side (the trend has changed) – open one “trial” position Stop loss -12 (spread not included), Take profit +5. Once profit target has been hit – look for the best that current price can offer and open three equal orders. Stop loss for all orders is -12 pips (without spread), profits will be taken next way:

1st order – close in 5 pips and later constant re-entry-scalping with rules described below.

2nd order – close on 14th (or 18th) SAR dot (whichever SAR got first 14 dots – just count them) – this gives us some relief that we have scored something. Also you may not wait till certain number of dots and just close second order where you fill it is a good gain to secure.

Another option: if you are familiar with waves and know what price retracement means, look to close 2nd order after the first, at most second clearly noticeble retracement and once the price has recovered and gave a strong move forward.

3rd – this order remains open and it is our constant relief that we are always earning something as long as both SARs are in agreement that the trend is alive. We close 3rd order only with the first SAR dot (any of 2 SARs) appearing on the opposite side signaling of a reversal.

Or if you feel it is enough for you – do not hesitate and close it earlier!

We trade both currency pairs at once. In total we run 6 open orders maximum.

EUR/USD and GBP/USD have over +90 in correlation which means they move simultaneously almost always. It helps to anticipate good or bad signs watching two pairs at once.

If with the first “trial” entry we have loss, open next “trial” position only when both SARs have agreed on the trend. (You may always wait for 2 SARs to be in agreement before entering any trade, but then sometimes you will miss most of the price move).

Now let’s move to our order # 1 which is going to be reopened to scalp the market with 5 pips in profit.

Stop loss will remain -12 pips. Profit target +5 pips.

Once hit 5 pips and we are on the same candle (price bar) set limit order on the same candle half way from the current price (this is not to be calculated, just approximately, also you may check previous candle extremes and set order accordingly). In other words, “half way” means half of the candle’s current body while the candle continues moving up and down). So, set half way below (for uptrend)/above (for downtrend) the recent price – what we want here is for the price to pull back, fulfill our order and bring us another 5 pips on the same spot. If it does not retrace – we will not worry as we have our two other orders gaining profits for us.

If a new 5 min candle appears, then project (visually) possible future retracement/pullback close to 8SMA and set limit order there – in other words, make your limit order “sit” on the tip of 8EMA line). Reposition your limit order with each new candle.

Now let’s play around 8 SMA. The price really “knows” this SMA.

a) If most of the candle has closed above (uptrend)/below (downtrend) 8 SMA for the first time – buy/sell accordingly.

b) For uptrend when price touches 8 SMA for the first time from above and current candlestick closes above or on 8 SMA – buy, but only if MACD’s histogram is not sloping down and about to cross 0 line or already below 0 line. If conditions are not met – sit and wait...

...And wait for the same MACD’s histogram to go below 0 line with the new candle and create a sharp turn (usually) or a rounding turn (not often). Enter on the close of the current candle after the sharp or rounding turn is spotted.

c) Constantly watch the price approaching SAR dots as once they meet – SAR indicator will signal for the change of the trend with the new dot not matter what, therefore if spotted – prepare to exit – do not wait for the SAR as it will redraw signal only in 5 min interval – valuable time can be lost. Instead watch the price, find the best “offer” and exit early with minimum loss.

If one currency pair is showing change in trend – e.g. got signal on SAR indicator, but the other does not – exit on both anyway. Pairs move simultaneously. So the other reverse signal is on its way to appear. You may find at times that EUR/USD pair usually moves slightly ahead of GBP/USD.

d) If the price for the first time has breached 8 SMA and closed on the opposite side – start watching closely the next 3 candles: if it comes back, closes on your side and goes in your favor – OK, but if price comes back, closes on your side and soon after goes and “attacks” 8SMA again and closes on the opposite side – exit with all you orders at the first suitable moment, because it is a strong (about 80%) sign of the trend reversal.

Once again the safest mode is:

If two SARs are in disagreement – stay out. Once both are telling the same thing – get in.

Happy scalping!

Scalping system #4 (5 pips with GBP/USD)

This simplified trading system derived from the previous “2 SARs to go” system and is a work of our dedicated scalper – Alex Wakemann. Thank you, Alex! His scalping insights will be published and updated on our pages as we move on. With this Forex scalping system Alex claims to always get at least 5 pips per trade.

Trading setup

Trading pair: GBP/USD

Time frame: 5 minute chart

Indicators:

MACD (5, 8, 9)

SAR on MACD (0.1, 0.11)

SAR on the chart (0.1, 0.11)

Trading rules

Trade only from 7:30 am EST to maximum 11:30 am EST. Preferred days – Tuesday to Friday.

Once both SARs are in agreement, e.g. suggest the same buy or sell opportunity – enter with either 1 order (to get 5 pips and leave the trade) or 2 orders at once (to chase the market further).

A stop loss is adjusted upon entry to the last but one SAR dot on the chart. If at the moment of the entry there is only one dot on the chart – set stop at this dot.

Profit targets – 1st – 5 pips.

2nd – only when an opposite signal appears – both SARs change direction or when the stop (by that time it is usually a profit stop or at least a break even situation) is hit.

If before that you feel that profits are already high to keep – lock them in earlier.

FOREX SCALPING SYSTEM

Now about exits:

If while keeping an open trade one SAR suggests an opposite trend, but the other does not – stay in trade.

Remember – a stop loss is always at the second nearest SAR dot on the 5 min chart.

With each new SAR dot – adjust stops for all orders to the second nearest SAR dot.

Why second? I found that very often the first SAR dot can be hit, but the second will hold. At that time I do not move my stop and sit tight until the SAR reverts and I can continue trading.

Additional notes: want even a better entry? Then open an additional 1 minute chart with the same settings and once got a signal from 5 min chart, look at 1 minute. Does the price confirms/moves in your direction or is it going the opposite way (temporarily making small corrections)? With the second option you have a time to wait until the price on 1 minute chart aligns with 5 minute chart.

Happy Forex scalping!

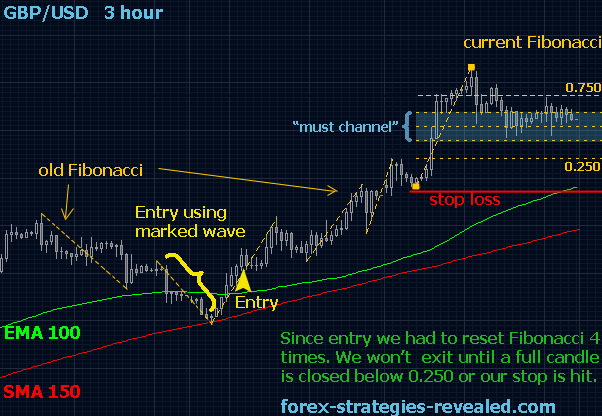

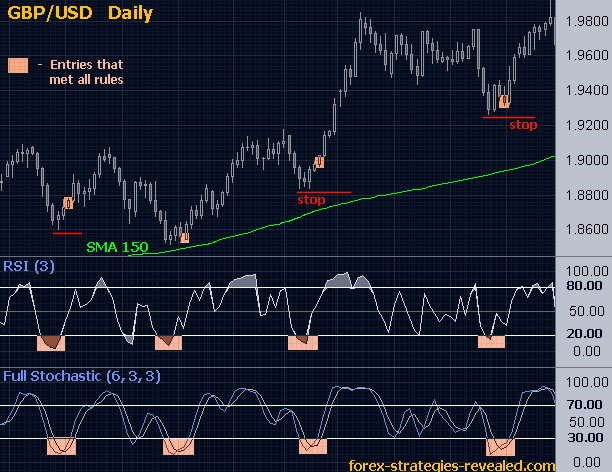

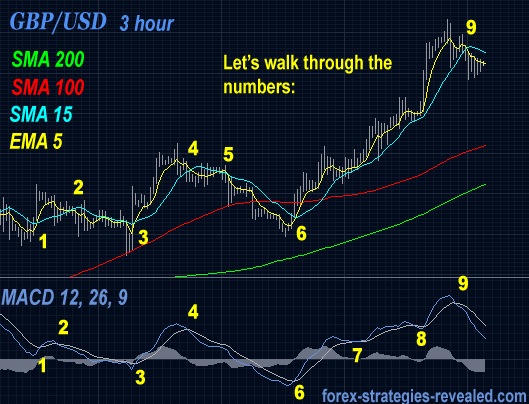

Scalping system #5 (Tops & Bottoms)

Probably the greatest dream of all scalpers is to be able to pick the right top or the right bottom of the price when trading Forex.

We are glad to bring to your attention the system that may become one of your favorite.

To save time we won't re-post it here, please follow next link to read the rules: "Tops and Bottoms" Forex trading System.

Simply follow the rules and aim for a short target/quick profits no matter what time frame you will end up with while searching for the required parameters.

For exits you may follow next suggestions, or create your own rules:

1. Exit on the close of the first long profitable candle when trading 1 hour or higher time frames.

2. Exit after 2 (or 3) consecutive profitable candles from the moment of entry when trading small time frames.

3. Exit with Bollinger Band as described in the strategy.

Happy scalping!

Edward Revy and my best Forex strategies Team

http://forex-strategies-revealed.com/

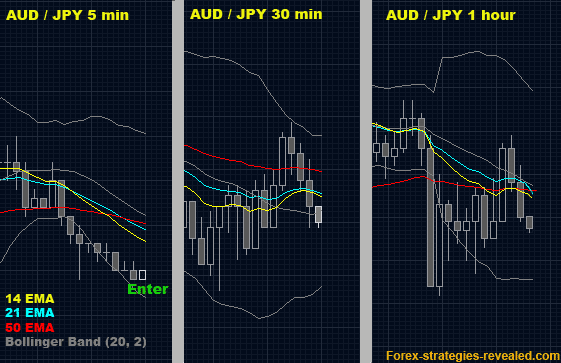

Scalping system #6 (EMA Bands)

This scalping system was sent by Frank Tenerife (Spain).

Thank you Frank! You contribution is greatly appreciated.

Here is the system:

"This is an efficient system of scalping that works in 1 minute up to 1 day all periods and all Currency

Ema 3

Ema 5

Ema 7

Ema 9

Ema 11

Ema 13

Color yellow

Ema 21

Ema 24

Ema 27

Ema 30

Ema 33

Ema 36

color Green

Ema 55 Color Red

Well

The system in The Oanda Forum.

And Way Works is

Buy Or Sell When the Group of Ema`s Yellow Breaks Ema 55

Take Benefit When Yellow Group Touches The Group Green.

If The Yellow group does Pull Back in Ema 55 or In Green Group Buy or sell again

Take Profit 10 Pip in Breaks Ema 55 And take Profit 5 pips In Pull Back

Stop loss 5 Pip 5 Minute Periods

The Good thing is Works with All periods and all the Currency

Forex scalping strategy

Grasias

Frank Tenerife Espa?a "

Happy scalping!

Scalping system #7 (Great GBP/JPY 1M scalping strategy)

So here is a strategy I have trying to work out fot the past month, and I seem to be getting better at it. What would be very nice, is if anyone can help me tune it a bit more.

Currency: GBP/JPY or USD/JPY (though i use it mainly on gbp/jpy:

Timeframe: 1M, 5M, 15M

Indicators: 3 sets of bollinger bands:

1) Period 50. Deviation 2 (RED)

2) Period 50. Deviation 3 (orange)

3) Period 50. Deviation 4 (Yellow)

(the template for this bollinger bands can be downloaded form this post)

Once you load your template you will notice the three sets of bollinger bands. Now, price will constantly range between these lines.

Sell strategy:

When price crosses the upper red band , at least half way to the orange band (if it gets to the yellow band is better but not as usual) Then the price will tend to retrace towards the center of the bollinger bands, you profit form this retracing.

Buy Strategy, it is the same as selling, the difference is that we will wait for the price to range between the lower red and yellow bands, and trade the retracing towards the center.

Tips: do not trade on ranging ,or quiet markets, do not trade previous to news releases. Go for 5 to 10 pips. Great system to trade between opening of london session and the closing of the japan session.

Stop Loss: since this strategy requires you to look at the screen (remember this is the 1M time frame) I tend to have two kinds of stops: time based and loss based.

Time based: Try and figure out how long will it take the market to get in your expected direction, if the time that you planned is already due, then close the order. No point on waiting for a loss...

Stop Loss: Since you are trading a very tight time frame your stops should also very very tight. Sometimes, you will profit from a 3 minute trade and you wont be able to set a proper S/L. So your stops will be given to you by your money management system...

What I would like to do is to study wether to add or not some extra indicators. I attach the results from my last week 102% profit, +80% of profitable trades.

Any help is welcome

Chelo

Template is attached as Zip file and goes in your templates folder in the MT4 directory...

| Attachment | Size |

|---|---|

| scalping.gif | 36.44 KB |

| DetailedStatement.html | 38.79 KB |

| 1minuto.rar | 501 bytes |

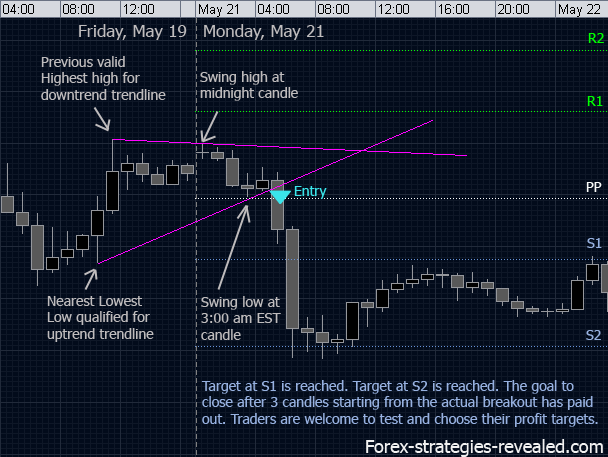

Scalping system #8 (1 minute Scalping with Pivot Points) more to come..

The idea behind scalping at Pivot levels is simple. Pivot points are excellent levels of support and resistance. The moment price comes and touches them it bounces off like a rubber ball. Why not benefit from it?

The rules for scalping with pivot points in Forex are simple:

Calculate Daily pivot points for your favorite currency pair. For calculation use data from 5 pm Eastern time to 5 pm next day Eastern time.

Sit and watch 1 minute chart. Be patient. Let price touch any of pivot point lines, or come at least on pip away from it. Believe me, your patience will pay off. The price do touch pivots 90% of the times. 90% is a lot. Enter with larger than you would regularly do order, but be reasonable.

Set stop loss 3 pips + spread on the other side of the pivot line.

Take profit once available - I would usually close my trade within the first completed 1 minute candle and as soon as I'm profitable.

That's it. Enjoy scalping pivots, it's fun which brings profits along.